"*" indicates required fields

2024 Florida Child Support Laws

Key Takeaways

- The State of Florida has new child support laws recognizing unmarried fathers’ parental rights.

- Establishing paternity is now easier for fathers, who can have more access to their children and be more active in their lives.

- When major life changes occur, non-custodial parents can request a modification in court-ordered child support.

- Working with a knowledgeable and skilled Florida family law attorney can help in matters relating to child custody and child support.

- Key Takeaways

- What Are Florida’s Child Support Laws?

- How Can a Father in Florida Establish Paternity?

- How is Child Support Calculated in Florida?

- Can Florida Child Support Orders be Modified?

- What About Florida Child Support Deductions?

- When Does Child Support End in Florida?

- How Can You Stop Child Support Payments in Florida?

- How Are Florida’s Child Support Guidelines Applied?

- How Does Child Support Enforcement Work in Florida?

- Can There Be Deviation From the Child Support Guidelines in Florida?

- Can Child Support Be Ordered Retroactively in Florida?

- Why Work With Cordell & Cordell

- We Believe Parenthood is About More Than What You Can Pay

- Frequently Asked Questions

Thankfully, Florida is moving in the right direction with a new law acknowledging what fathers have been saying for years: they are more than their wallets to pay child support.

In this article, we’ll cover the ins and outs of Florida child support laws, what exactly the new child support laws mean for Florida fathers, and how you can fight for your right to take care of your child beyond child support.

To schedule a consultation with Cordell & Cordell, call us at 866-323-7529 (323-7529).

What Are Florida’s Child Support Laws?

In most cases, child support is mandatory in Florida. The purpose of child support is to make sure that both parents are still financially responsible for the child, even after a divorce. Child support can also be imposed on a parent once paternity has been determined, even if that parent did not know of the child’s existence.

In Florida, a person who is obligated to pay child support is called the “obligor parent,” and the person entitled to receive child support is called the “obligee parent.” When parents are married, they have a legal obligation to support their children. This responsibility remains even when the parents divorce or if the parties have never been married. Both parents must continue to financially support the child until they turn eighteen (18) years old, or if they are still in high school at the age of eighteen (18) years old, the child support obligation will continue until the child graduates from high school.

The Florida Department of Revenue oversees child support payments. It helps Florida citizens locate parents, establish paternity, determine assets, and establish and modify child support orders. The department monitors payments and helps a parent take action if the other parent does not pay their support on time. It can also receive and distribute payments. If needed, it also offers parenting classes.

Another term frequently used in child support issues is the term “guidelines.” This term refers to the guidelines which are set forth in Florida law for the courts to use when calculating the amount of child support owed. Learn more about the specifics of the Florida child support laws and guidelines below.

New Florida Child Support Laws in 2024

In July 2023 Florida passed a new law (Statute 742) which gives unmarried fathers automatic parental rights that previously only the mother of a newborn would receive. Fathers can now immediately be active participants in their children’s lives.

Previously, unmarried mothers were given the exclusive right to be the child’s “natural guardian” with 100% of parenting rights at birth. Unmarried fathers were only given the right to pay child support and perhaps gain more rights if they brought the case to court.

How Can a Father in Florida Establish Paternity?

At birth: At the Hospital

- If parents are married, the father’s paternity is established and no action needs to be taken.

- If parents are unmarried, paternity can be established voluntarily by both parents.

Age 0 – 18 years: By Legitimation or Acknowledgement

- If a child is born to unmarried parents who later marry, paternity can be established when the parents apply for a marriage license.

- In the case of parents not being married, paternity can be voluntarily established by both parents.

Age 0 -18 years: By Order

- If paternity had not previously been established, it can be established through a legal court order.

- Paternity can be ordered outside of court.

- A judge can order paternity in court.

- Both options determine paternity through genetic testing.

How is Child Support Calculated in Florida?

Child custody and child support are two different determinations. Child custody establishes who will have legal and/or physical custody or, as we term in Florida, parental responsibility for timesharing of the child. These can be joint, where the parents share responsibility, or it can be sole, where one parent is mostly in charge of the child. In general, the non-custodial parent will end up making child support payments to the other parent. Determining custody is generally done through Florida family courts.

Determining who pays child support and the amount that is owed can be a difficult task. When making these decisions, the courts follow the Income Shares Model that considers several monetary factors of both parents, including:

- Wages and salary

- Bonuses, commissions, and tips

- Disability benefits

- Spousal support

- Worker’s compensation

- Social Security payments

- Retirement and pension plans

- Property ownership

- Unemployment assistance

- Other forms of compensation through self-employed or contractor work

After the total amount of a parent’s gross wages is calculated, deductions are subtracted from the amount. These include taxes, other spousal support, and any additional child support payments. This net amount is then used to determine the total amount of money you need to pay by using specific state-mandated guidelines.

In the event the other party is unemployed, underemployed, or not making as much as you potentially could in an attempt to lower child support payments, the court may “impute” income. In other words, if you are intentionally not working at your true capacity, the court may calculate an appropriate salary for you as if you were working to determine the amount of support owed. However, this is only used when the reduction in hours or pay is at the discretion of the party. This is used to help the receiving party when the paying party tries to conceal their true income to pay less child support.

Can Florida Child Support Orders be Modified?

To modify child support orders in Florida, you’ll need a substantial change in circumstances. You can file a petition anytime, and it will result in a change of at least 15% or $50, whichever is greater. A request to modify child support could be related to changes in:

- Income status

- Job status (new job or unemployed status)

- Disability status

- Additional child or other support orders in effect

One of the greatest challenges faced is that the income used in the original proceedings is likely incorrect. Oftentimes, attorneys try to “crowbar” numbers and manipulate child support to come out the way they want. Later, during a modification, they might not meet the threshold because the original documents don’t reflect accurate income.

What About Florida Child Support Deductions?

As you can see, almost any income source can be considered and will be included when calculating child support. However, there are still several deductions that a party may qualify for, which would lower their child support payments. While this is not an exhaustive list, some examples of deductions include:

- Federal, state, and local income tax deductions

- Retirement payments

- Health insurance payments, except for those concerning the minor child

These deductions lower the total amount of income earned by a party that the court can use to determine their obligation of child support payment. This becomes especially important when the court calculates the net income of both parents.

When Does Child Support End in Florida?

Once child support is determined, parents will continue to pay the set amount until the child turns 18. Some special circumstances may exist that extend the length of payment, like graduation from high school after the age of eighteen (18) or if the child has a disability.

Child support laws in Florida provide that the court “may order either or both parents to support a child” until either the child turns 18 or graduates from high school (the later of the two), the child is emancipated by marriage, the disabilities of the child are removed, or the child dies. However, as further discussed below, if the child is deemed to be disabled by the court (physically or mentally), then the child may receive support indefinitely.

How Can You Stop Child Support Payments in Florida?

It is possible to alter child support payments. This, too, has specific qualifications that must be met, and it can be hard to change payment calculations or schedules. It is usually only done when one parent can show that the other has had a major and ongoing financial change. Examples include a change in job status or coming into a substantial amount of money, like from an inheritance or winning the lottery.

Stopping child support payments in Florida can be even more difficult, but it can be done. Some ways to do this include:

- An agreement between the parents: If both parents agree, child support payments can be waived or stopped. It is important to note that a judge has the right to supersede this agreement if they feel it is unfair. This means that a judge can still order child support even if both parents state they do not need it. In practice, the judge tends to follow parental agreements unless they suspect one parent has not entered the decision in good faith.

- Give up your parental rights: A parent can decide to do this but they will have to follow specific state guidelines. If a parent surrenders their parental rights, they do not have to pay child support anymore. However, this also means that they no longer have any say in what the child does, and they cannot request visitation rights. In some instances, the custodial parent may ask the non-custodial parent to give up their rights. This is generally done when the custodial parent either has a new partner that wants to legally adopt the child, or they do not want the child to know the other parent.

- Terminating any child support agreement: The support agreement will be void when the child turns eighteen (18) unless there are special circumstances. It is also automatically terminated if one parent dies. The court could also terminate the agreement if you lose your job or if you go to prison. In these cases, the court will more than likely be inclined to alter payments rather than terminate them altogether.

How Are Florida’s Child Support Guidelines Applied?

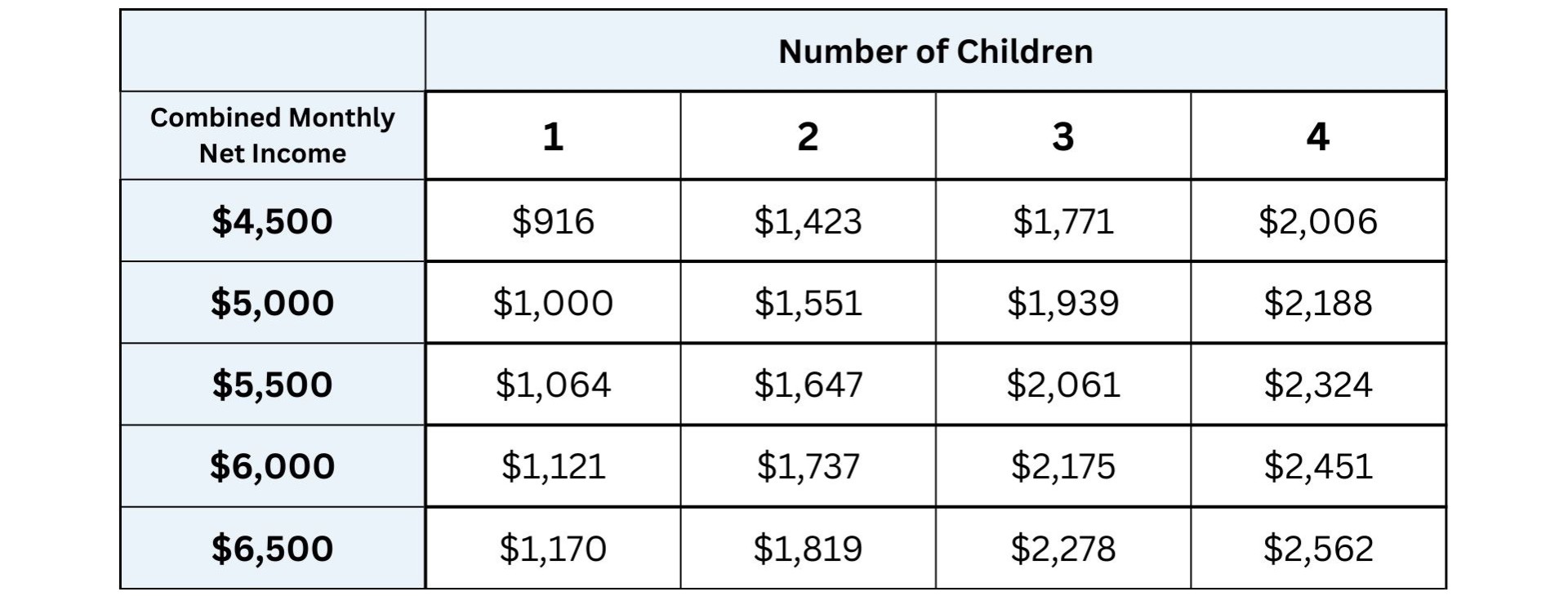

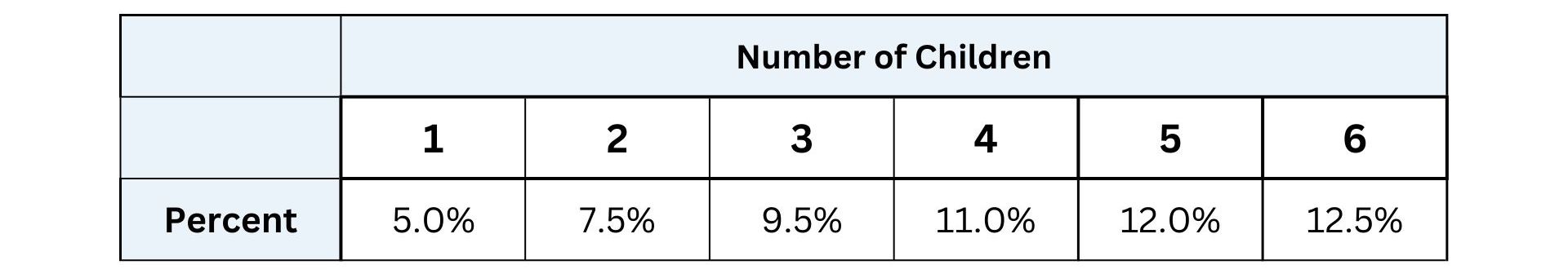

Once the court has calculated your total income, the judge will use this number to determine how much child support is owed based on the Child Support Guidelines from Florida Statute 61.30.

Even though the guidelines seem like a rigid set of rules that the court must follow, they have some flexibility when determining the amount of child support in a case. The court automatically has the discretion to set the child support five percent above or below the amount in the guidelines.

Any deviation from the guidelines greater than five percent must have a written finding to support why the different amount is warranted. For example, if a party’s child support obligation pursuant to the guidelines is $500, the court can automatically adjust the amount to $475 or $525 based on what they find is suitable for the given situation.

In addition to the court’s discretion regarding the amount of support owed, these figures also automatically adjust based on how many children the couple share. For example, if the parties have a net income of $2,000, the guidelines state $442 in support will be granted for one child, $686 for two children, $859 for three children, and so on.

Once the amount of support has been determined, the court will find how much each party will be responsible for. The paying parent will pay a portion of the amount found by the child support guidelines based on their percentage of the total net income.

If the guideline determines $500 as the total amount needed for the child and both parties are earning an equal amount, each parent would be responsible for $250 each month; however, if the non-custodial party makes 60% of the party’s net income, they would pay 60% of the child support amount: $300.

For combined monthly net income greater than the amount in the guidelines schedule, the obligation is the minimum amount of support provided by the guidelines schedule plus the following percentages multiplied by the amount of income over $10,000.

No two cases are identical, which makes it crucial to have proper legal guidance when understanding your child support rights and responsibilities. Contact Cordell & Cordell’s child support attorneys for men to learn your options.

How Does Child Support Enforcement Work in Florida?

Custodial parents can seek assistance from the Clerk’s Office. If payment is overdue by 15 days, the Clerk’s Office will send a Notice of Delinquency. If unpaid within 20 days, the respondent will receive a judgment. If nonpayment still occurs, the case is escalated and more serious consequences will occur.

Noncustodial parents who owe $5,000 in past due support and four prior convictions of nonpayment amounts to a felony. Some may receive jail time.

Can There Be Deviation From the Child Support Guidelines in Florida?

The court may determine that the guidelines are unjust or inappropriate and may deviate. The court may deviate from guidelines if the evidence shows that the “best interests” of the child justify a deviation. According to Florida’s child support laws, the court can basically consider anything that is relevant, including a number of statutory factors.

For example, the court can consider the following:

- The age and needs of the child

- The ability of the parents to contribute to supporting the child

- The amount of time and possession of and access to a child

- Financial resources available to support the child,

- Childcare expenses

- Special or extraordinary education

- Health care

- Other expenses

Can Child Support Be Ordered Retroactively in Florida?

If an obligor has not been paying child support, the court can order retroactive child support to be paid to the obligee. In determining the amount of retroactive child support, the court must look to the “net resources of the obligor during the relevant time period” and the following factors:

- Whether the mother had made any attempts to let the father know of his paternity (or the possibility of)

- If the father knew of his paternity (or the possibility of)

- Whether an undue hardship will be imposed on the father

- If the father had provided actual support or necessaries before the filing of the action

The court can order retroactive child support to be paid for the two (2) years preceding the date of the support petition. The court will presume that two (2) years of retroactive is in the best interest of the child.

However, the obligee can argue that retroactive child support for more than two (2) years is in the best interest of the child if they can show that the obligor “knew or should have known that the obligor was the father of the child” and “sought to avoid the establishment of a support obligation to the child.”

Why Work With Cordell & Cordell

As you can see, Florida’s custody laws can become very complex to navigate on your own. Our Florida child support attorneys are here to provide you with legal advice and tenacious representation.

Due to the occasional bias that men face in family court, our attorneys know how to advocate for fathers. We are aggressive where warranted in custody and domestic matters when men need someone to stand up for them to protect their family and financial interests.

Testimonials

“My attorney did a fantastic job and twice now this firm has helped me very much. My attorney a few years ago was also amazing. This firm has taken great care of me and is worth the money. Everything was exceptional.” — Christopher K.

“[My Attorney] did a great job! She was very professional and informative.” — Joseph C.

We Believe Parenthood is About More Than What You Can Pay

Cordell & Cordell’s attorneys are committed to protecting and advocating for parent’s rights. Our compassionate child support lawyers know the challenges parents face, and we’ll actively seek to help you.

To schedule a consultation with a Cordell & Cordell Florida family law attorney, contact our law office at 866-323-7529 (323-7529) or, if preferable, fill out our contact form. For the convenience of our clients, we also offer resources to help, including podcasts, townhalls, and eBooks.

Frequently Asked Questions

Courts typically do not allow parents to stop child support. However, parents have options to achieve this goal through stipulated child support agreements or modification of child support.

Child support arrears in Florida are not forgiven. If a life change occurs that affects your financial stability, you can request a modification order so you do not fall behind child support payments.

Yes. Florida is strict because support is in the best interest of the child. Florida courts pursue child support through garnished wages, withdrawal from bank accounts, and selling assets from estates after death. Courts may also issue contempt of court order, suspend a driver’s license, or suspend a passport.

Written by Joseph E. Cordell

Joseph E. Cordell is the Principal Partner at Cordell and Cordell, P.C., which he founded in 1990 with his wife, Yvonne. Over the past 25 years, the firm has grown to include more than 100 offices in 30 states, as well as internationally in the United Kingdom. Mr. Cordell is licensed to practice in the states of Illinois and Missouri and received his LL.M. from Washington University in St. Louis, Missouri. Joseph E. Cordell was named one of the Top 10 Best Family Law Attorneys for Client Satisfaction in Missouri.

- Key Takeaways

- What Are Florida’s Child Support Laws?

- How Can a Father in Florida Establish Paternity?

- How is Child Support Calculated in Florida?

- Can Florida Child Support Orders be Modified?

- What About Florida Child Support Deductions?

- When Does Child Support End in Florida?

- How Can You Stop Child Support Payments in Florida?

- How Are Florida’s Child Support Guidelines Applied?

- How Does Child Support Enforcement Work in Florida?

- Can There Be Deviation From the Child Support Guidelines in Florida?

- Can Child Support Be Ordered Retroactively in Florida?

- Why Work With Cordell & Cordell

- We Believe Parenthood is About More Than What You Can Pay

- Frequently Asked Questions

Florida Resource Articles