With an estate plan, you stay in control of decisions about your care and assets, protecting your family from uncertainty and unnecessary costs.

Book Your Consultation

Act now to protect your future. Let’s create a plan tailored to your goals. Contact us today!

A Clear Plan. A Fair Price. Peace of Mind.

Our pricing is flat-rate, transparent, and built to give you confidence in your next step.

Will Packages: Individuals: $1,649 | Couples: $2,499

Trust Packages: Individuals: $2,795 | Couples: $3,995

Power of Attorney Packages: Individuals: $650 | Couples: $1,000

Will Packages:

Individuals: $1,649 | Couples: $2,499

Trust Packages:

Individuals: $2,795 | Couples: $3,995

Power of Attorney Packages:

Individuals: $650 | Couples: $1,000

What Is Estate Planning?

Estate planning is about making sure your wishes are carried out and your family is cared for. With tools like wills and trusts, you can decide who receives your property, reduce costs and delays, and make things easier for the people you love.

Who Needs an Estate Plan?

If you own a home, have children, or keep savings and investments, planning ahead is important. Without a plan, important decisions are left to the courts. A well-prepared plan gives you control and provides peace of mind that everything is handled the way you intend.

Why Cordell & Cordell?

Estate planning is personal, and so is our approach. We listen first, explain your options in plain language, and then create a plan tailored to your goals. Our attorneys focus on clarity, compassion, and results, so you can move forward with confidence.

The Cordell & Cordell Estate Planning Process is Simple

Attend Your Initial Consultation

Meet with one of our estate planning attorneys. We will discuss what is right for your personal situation—in order to tailor a plan to meet your goals. All of your questions will be answered by our experienced attorneys.

Review Your Draft Documents

We will create a complete, personalized estate plan and send it to you via mail or email for review. Simply provide us with any questions or requested changes.

Implement Your Plan

When you are satisfied with your drafts, schedule a time for us to execute them, together. Our estate planning attorneys will also provide you with instructions on how to retitle your assets. You will leave with copies of your estate plan in hand and complete peace of mind.

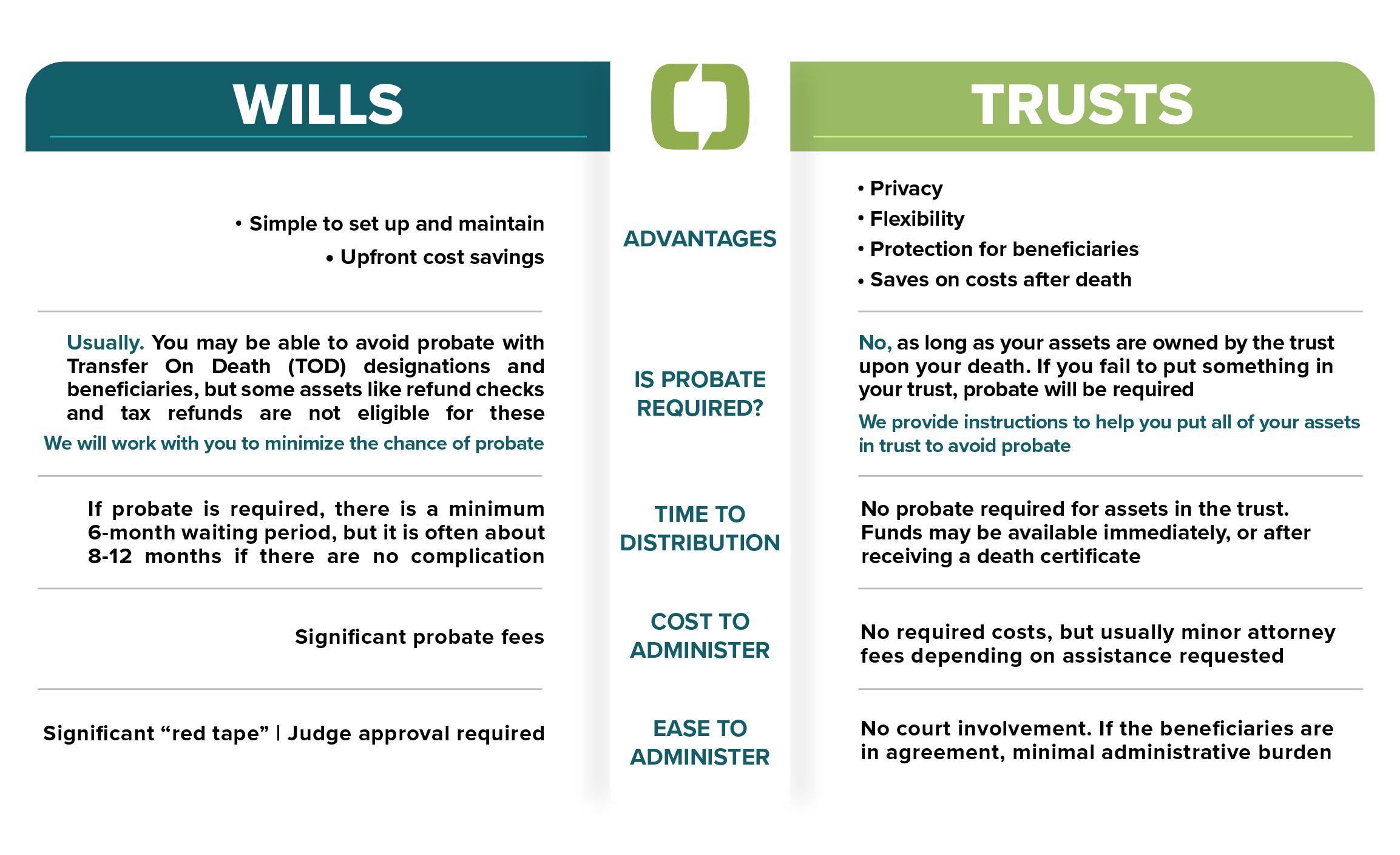

Will or Trust - Which One Do You Need?

Wills and trusts serve different purposes. This quick comparison will help you see the key differences at a glance.

Advantages: Simple to set up and maintain

Is Probate Required?: Usually. You may be able to avoid probate and Transfer On Death (TOD) designations and beneficiaries, but some assets like refund checks and tax refunds are not eligble for these. We will work with you to minimize the chance of probate.

Time To Distribution: If probate is required, there is a minimum 6-month waiting period, but it is often about 8-12 months if there are no complications.

Cost to Administer: Significant probate fees

Ease to Administer: Significant "red tape". Judge approval required.

Advantages: Privacy, flexibility, protection for beneficiaries, saves on costs after death.

Is Probate Required: No, as long as your assets are owned by the trust upon your death. If you fail to put something in your trust, probate will be required. We provide instructions to help you put all of your assets in trust to avoid probate.

Time to Distribution: No probate required for assets in the trust. Funds may be available immediately, or after receiving a death certificate.

Cost to Administer: No required costs, but usually minor attorney fees depending on assistance requested.

Ease to Administer: No court involvement. If the beneficiaries are in agreement, minimal administrative burden.

Book Your Consultation

Act now to protect your future. Let’s create a plan tailored to your goals.

Give us a call or choose a location below to schedule your consultation today!

833-825-4388

What is Included in your Estate Planning Packages

| Will Package | Trust Package | |

|---|---|---|

| LAST WILL & TESTAMENT A Last Will & Testament provides instructions to the probate court indicating your exact wishes about who will care for your children, who is in charge of implementing your wishes (your executor) and how your property will be distributed. Your will and all other documents filed with the probate court will be public record. | ✔ | |

| REVOCABLE TRUST A Revocable Trust accomplishes everything that a will does, but with the distinct advantage of avoiding the probate court process. “Revocable” means that you retain control over your finances, possessions, and wishes during your lifetime. At any time, you can change your mind by amending or even revoking your Revocable Trust. | ✔ | |

| WILL A Pour-Over Will is used in conjunction with a revocable trust. It acts as a safety net to ensure that any property not transferred into your trust during your lifetime “pours into” it upon your death. | ✔ | |

| FINANCIAL POWER OF ATTORNEY A Financial Power Of Attorney gives the person you designate the power to handle your financial decisions, such as paying your bills or filing your taxes. | ✔ | ✔ |

| HEALTHCARE DIRECTIVE (LIVING WILL) A Healthcare Directive tells your physician and family the extent of medical care you wish to receive if you are unable to communicate these things yourself. | ✔ | ✔ |

| MEDICAL POWER OF ATTORNEY A Medical Power of Attorney gives the person you designate the legal authority to make medical decisions on your behalf if you are unable to do so. | ✔ | ✔ |

| HIPAA RELEASE A HIPAA Release gives your physician permission to discuss your personal medical information with the person you have granted your medical power of attorney, as well as any others whom you may choose to designate. | ✔ | ✔ |

| DEED Filed with the Recorder of Deeds, a deed avoids the probate court process and transfers title to your property to your designated beneficiary (including your revocable trust) either immediately or upon your death. Your real estate remains titled in your name during your lifetime, and you’re always free to change or revoke your beneficiary deed. | ✔ | ✔ |